proposed estate tax changes september 2021

Three Estate Planning Proposals to Watch. As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US.

Powerful Entry Level Engineering Resume Samples To Get Hired Engineering Resume Engineering Resume Templates Mechanical Engineer Resume

The tax bill dropped Monday by Democrats on the House Ways Means Committee includes an array of changes to estate assets trusts corporate taxes and business.

. Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to. President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. Bureau of Labor Statistics Consumer Price Index.

Build Back Better Act. House Democrats on Monday revealed a package of tax hikes on corporations and the rich without President Joseph Biden s proposed levy on inherited property at death. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

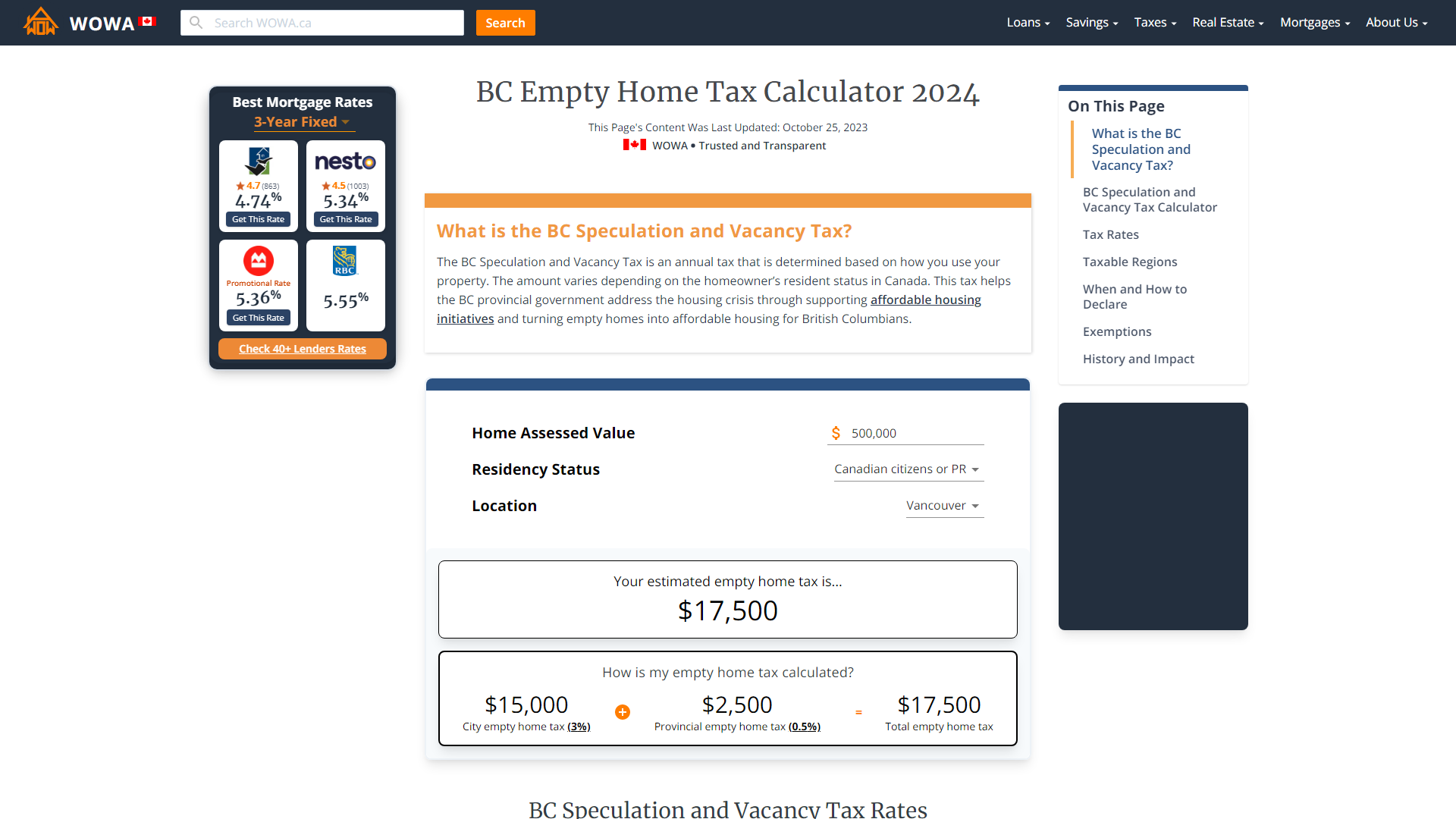

The 2017 Tax and Jobs Act increased the base estate gift and generation. This is proposed to be effective for. Proposed Estate and Tax Planning Changes in 2021 and 2022 On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be.

As of this writing on. Alicia Cole Wealth Management. The next article in this series will cover proposed income tax changes in basis rules and capital gains taxes affecting estate planning.

On September 13 2021 the House Ways and Means Committee released its proposed tax plan to fund President Bidens 35 trillion Build Back. Two of the most significant proposed changes include. Would reduce the estate tax exemption to 35 million from 117 million in 2021 and increase the progressivity of the estate tax with rates from 45 percent to 65 percent.

By David B. On September 13th the House Ways Means Committee released draft legislation that included reverting the estate tax exemption to pre. The 75 percent and 100 percent gain exclusion under 1202 for qualified small business stock would be unavailable on or after September 13 2021 for individuals who have.

Heres what you need to know. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million Imposition of capital gains tax on. Potential Estate Tax Law Changes To Watch in 2021 Estate Gift and GSTT Exemption.

Beth Burger September 17 2021. What you need to know. In September the House Ways and Means Committee released an extensive tax package that would have resulted in enormous changes for estate tax planning.

Under current law only total taxable gifts and taxable estates exceeding 11700000 per individual are subject tax in 2021. Other changes are set to be effective for transactions occurring on or after September 13 2021 including a 25 capital gains rate and having the sales of Section 1202. Proposed estate and gift tax changes.

House Democrats recently released additional legislative proposals that if passed. That is only four years away and. 2021 Proposed Tax Reform.

September 29 2021 Article 3 min read. On September 13 2021 House Ways and Means Committee Chairman Neal D-MA released his draft of the proposed tax portion of the Democrats 35 trillion 10-year. As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan.

As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan.

Glasbergen Cartoons By Randy Glasbergen For December 12 2021 Gocomics Com In 2022 Today Cartoon Funny Friday Memes Accounting Humor

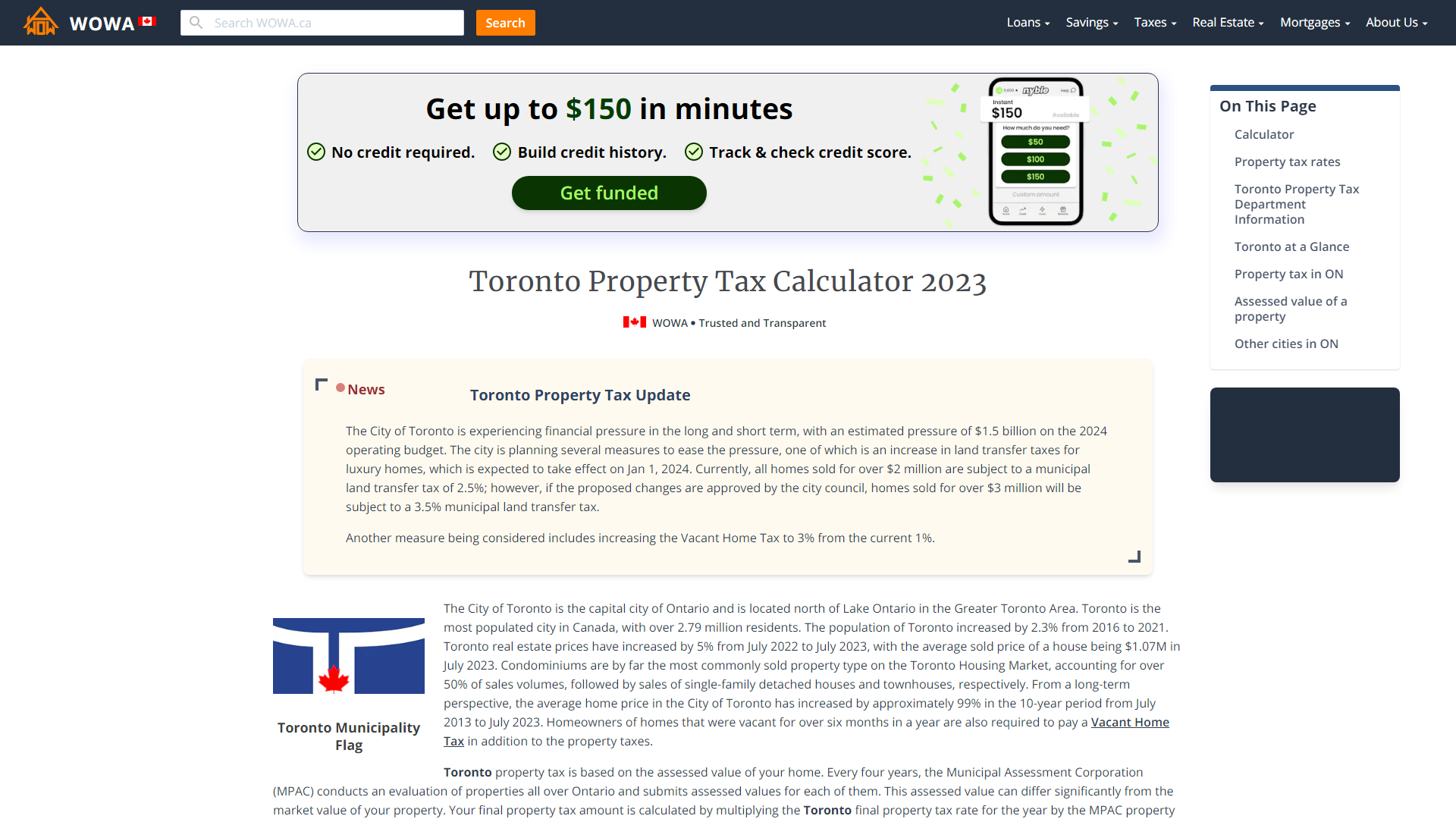

Property Taxes And Utilities Tsawwassen First Nation

How The Tcja Tax Law Affects Your Personal Finances

Investment Banker Resume Example Resume Examples Job Resume Samples Sample Resume

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

What Could Be In The Federal Budget Wolters Kluwer

Billionaire S Association With Luxury B C Mansion Highlights Property Tax Loophole Cbc News

Mutual Fund Investing Common Questions About Taxes In Non Registered Accounts

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Hubert Kairuki Memorial University Hkmu Osim Login Online Application 2021 2022 Un Jobs Job Opportunities Online Application

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return